PROXY STATEMENT

This proxy statementProxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Columbia Financial, Inc. (which we refer to in this proxy statement as “Columbia Financial,” “we,” “us,” “our,” or the “Company”) to be used at the annual meeting of shareholders of the Company. The Company is the holding company for Columbia Bank (the “Bank”).Special Meeting and at any postponements or adjustments thereof.

INFORMATION ABOUT THE SPECIAL MEETING

Time and Location

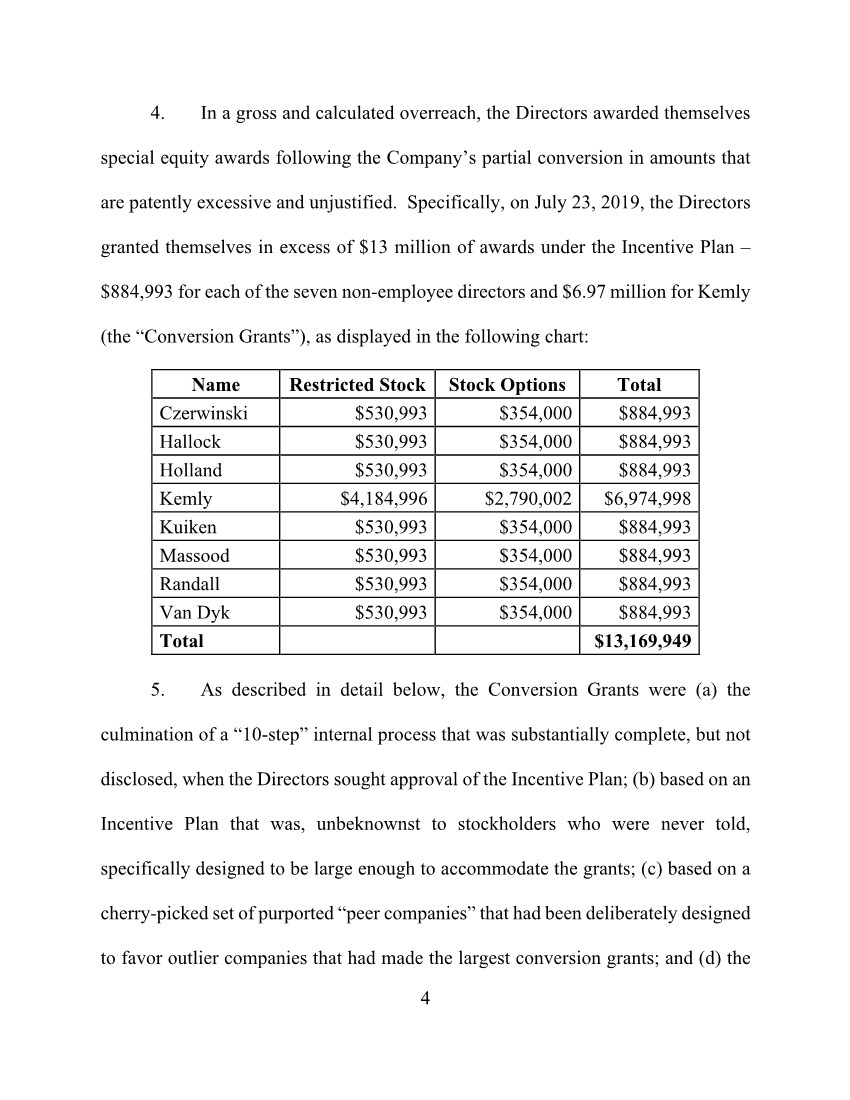

The annual meetingSpecial Meeting will be a “virtual meeting” which will be held at the Sheraton Mahwah Hotel located at 1 International Boulevard, Route 17 North, Mahwah, New Jersey 07495 on Thursday, June 6, 2019Monday, April 4, 2022 at 10:00 a.m., local time. A notice of internet availability of proxy materials regarding thisThis proxy statement is being first mailed to shareholders on or about April 22, 2019.February 23, 2022.

Who Can Vote at the Special Meeting

You are entitled to vote your shares of Columbia Financial common stock at the annual meetingSpecial Meeting if the records of the Company show that you held your shares as of the close of business on April 12, 2019.February 11, 2022 (the “Record Date”). If your shares are held in a stock brokerage account or by a bank or other nominees, you are considered the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by your broker, bank or other nominee. As the beneficial owner, you have the right to direct your broker on how to vote your shares. Your broker, bank or other nominee has enclosed a voting instruction form for you to use in directing it on how to vote your shares.

As ofOn the close of business on April 12, 2019, 115,889,175Record Date, there were 106,811,453 shares of Columbia Financial common stock were outstanding and entitled to vote.vote at the Special Meeting, including 69,930,210 shares held by Columbia Bank MHC, the Company’s parent mutual holding company. Each share of common stock has one vote.

The Company’s certificate of incorporation provides that record holders of the Company’s common stock who beneficially own, either directly or indirectly, in excess of 10% of the Company’s outstanding shares are not entitled to any vote with respect to those shares held in excess of the 10% limit. This provision does not apply to shares held by Columbia Bank MHC, the Company’s parent mutual holding company, which owned 62,580,15569,930,210 shares, or 54.0%,65.5 %, of the Company’s outstanding common stock as of April 12, 2019.the Record Date.

With respect to the Special Meeting, the shares held by Columbia Bank MHC will be counted for purposes of determining a quorum and such shares are expected to be voted in favor of Proposal 1, Proposal 2 and Proposal 3. However, in order for the proposals to be ratified, a majority of votes cast by the minority shareholders who are eligible to participate in the ratification vote must also vote in favor of ratification of the proposals. The shareholders who are eligible to participate in the ratification vote on Proposal 1, Proposal 2 and Proposal 3 (the “Eligible Shareholders”) are all shareholders of the Company on the Record Date, other than (i) Columbia Bank MHC, (ii) the Defendants, as defined herein, (iii) family members of the Defendants residing in the same household as a Defendant, and (iv) entities controlled by one or more Defendants.

Advance Voting MethodsMaterials

Even if you plan to attend the annual meeting in person,virtual Special Meeting, please vote in advance of the meeting using any one of the following advance voting methods (see page 3 for additional details).methods.

You can vote in advance in one of three ways:

•

Visit the website listed on your proxy card/voting instruction formcard or notice of internet availability of proxy materials to voteVIA THE INTERNET;

•

Call the telephone number on your proxy card/voting instruction formcard or notice of internet availability of proxy materials to vote BY TELEPHONE; or

•

If you received a paper proxy card, or voting instruction form, complete, sign, date and return the proxy card or voting instruction form in the enclosed envelope BY MAIL.

Attending and Voting at the Annual Meeting

If you are a shareholder as of the close of business on April 12, 2019, you may attend the annual meeting. However, if you hold your shares in street name, you will need proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from a bank, broker or other nominee are all examples of proof of ownership. If you want to vote your shares of Columbia Financial common stock held in street name in person at the meeting, you will need a written proxy in your name from the broker, bank or other nominee who holds your shares.

INFORMATION ABOUT THE MEETINGAttending the Special Meeting

As permitted by Delaware law, our Special Meeting will be held solely as a virtual meeting live via the internet, and not at any physical location. You will be able to attend the Special Meeting via live audio webcast by visiting the Company’s virtual meeting website at www.virtualshareholdermeeting.com/CLBK2022SM on Monday, April 4, 2022, at 10:00 a.m. Eastern time. Upon visiting the meeting website, you will be prompted to enter your 16-digit Control Number provided to you on your proxy card. Your unique Control Number allows us to identify you as a shareholder and will enable you to securely log on, vote and submit questions during the Special Meeting on the meeting website. Further instructions on how to attend and participate via the internet, including how to demonstrate proof of stock ownership, are available at www.proxyvote.com. Vote Required

The annual meetingSpecial Meeting will be held only if there is a quorum. A majority of the outstanding shares of Columbia Financial common stock entitled to vote, represented in person or by proxy, constitutes a quorum. If you return valid proxy instructions or attend the meeting in person,Special Meeting via live webcast, your shares will be counted for purposes of determining whether there is a quorum, even if you abstain from voting.

Our management anticipates that Columbia Bank MHC, our majority shareholder, will vote allattend the meeting for the purpose of its sharesestablishing a quorum and will vote in favor of all three proposals to be presented at the annual meeting.proposals. In addition, the Columbia Bank Foundation, in accordance with its governing documents, will vote at the Special Meeting, but as required by its governance documents, it must vote all the shares of Columbia Financial Inc. in the same proportion as shares are voted by all other shareholders.

•

Further, as discussed herein, ratification will also require the affirmative vote of a majority of the shares voted by Eligible Shareholders, who are all shareholders of the Company on the Record Date other than (i) Columbia Bank MHC, (ii) the Defendants, as defined herein, and (iii) family members of the Defendants residing in the same household as a Defendant, and (iv) entities controlled by one or more Defendants. The aggregate number of shares held by Eligible Shareholders as of the Record Date is 35,815,826.

Proposal 1 — — In voting on the election of directors, you may vote in favor ofapproval to ratify the nominees or withhold votes as2019 Equity Awards to the nominees. There is no cumulative voting for the election of directors. Directors are elected by a plurality of the votes cast at the annual meeting. “Plurality” means that the nominees receiving the largest number of votes cast will be elected up to the maximum number ofnon-employee directors, to be elected at the annual meeting. The maximum number of directors to be elected at the annual meeting is two.

•

Proposal 2 — In voting on the proposal to approve the Columbia Financial, Inc. 2019 Equity Incentive Plan, you may vote in favor of the proposal, vote against the proposal or abstain from voting. To be approved,ratified the proposal requires (i) the affirmative vote of a majority of the votes cast, in person or by proxy, at the annual meeting,Special Meeting, and (ii) the affirmative vote of a majority of the votes cast at the annual meeting,Special Meeting, in person or by proxy, by shareholders other than Columbia Bank MHC, the Company’s parent mutual holding company.

•

Eligible Shareholders.

Proposal 32 — — In voting on the approval to ratify the appointment of KPMG LLP as2019 Equity Awards to the Company’s independent registered public accounting firm,retired non-employee directors who have been in continuous service with the Company since their retirement, you may vote in favor of the proposal, vote against the proposal or abstain from voting. To be approved,ratified the proposal requires (i) the affirmative vote of a majority of the votes cast, in person or by proxy, at the annual meeting.Special Meeting, and (ii) the affirmative vote of a majority of the votes cast at the Special Meeting, in person or by proxy, by the Eligible Shareholders.

AbstentionsProposal 3 — In voting on the approval to ratify the 2019 Equity Awards to Thomas J. Kemly, you may vote in favor of the proposal, vote against the proposal or abstain from voting. To be ratified the proposal requires (i) the affirmative vote of a majority of the votes cast, in person or by proxy, at the Special Meeting, and Broker Non-Votes(ii) the affirmative vote of a majority of the votes cast at the Special Meeting, in person or by proxy, by the Eligible Shareholders.

Abstentions and “broker non-votes” are not considered “votes cast” and will therefore have no effect on the outcome of any vote takenproposals voted on at the annual meeting.Special Meeting. A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker, bank or other nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner. Broker non-votes will not be counted for purposes of determining the existence of a quorum.

Effect of Not Casting Your Vote

If you hold your shares in street name it is critical that you cast your vote if you want it to count in the election of directors (Proposal 1) or with respect to the proposal to approve the Columbia Financial, Inc. 2019 Equity Incentive Plan (Proposal 2).Proposal 1, Proposal 2 and Proposal 3. Current regulations restrict the ability of your bank or broker to

INFORMATION ABOUT THE MEETING

Voting by Proxy

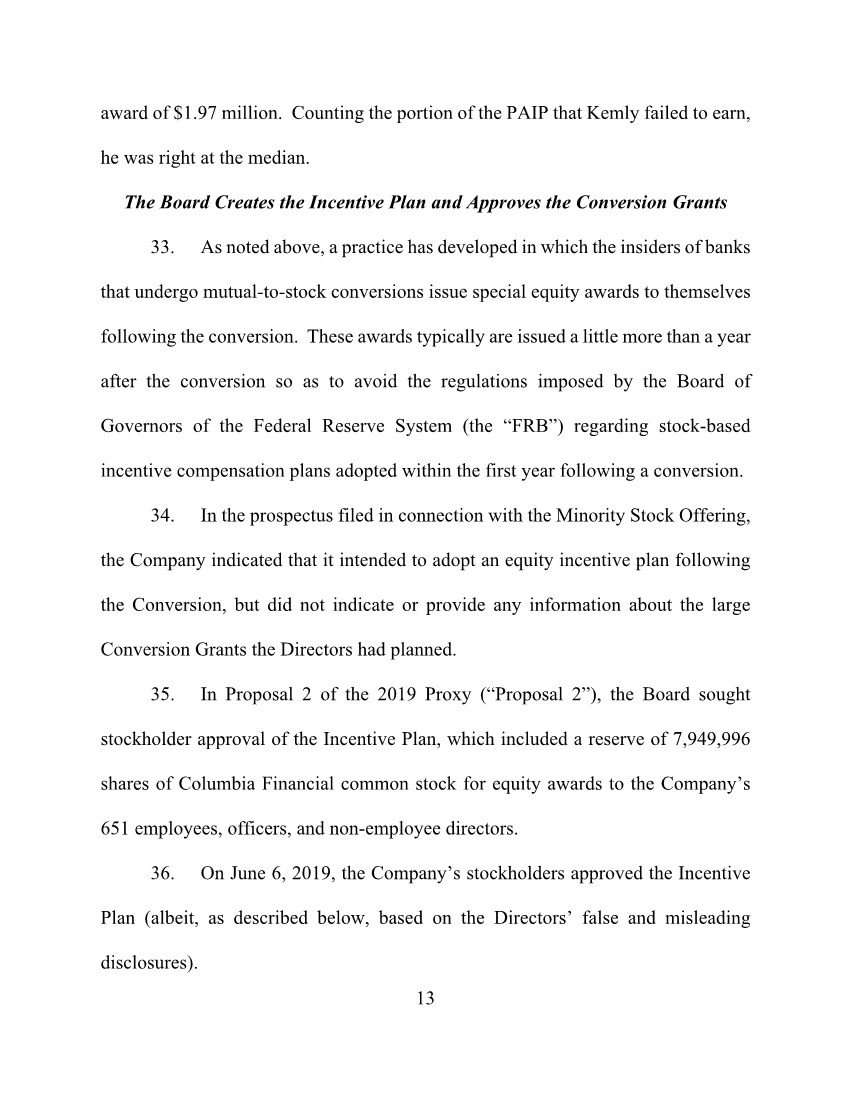

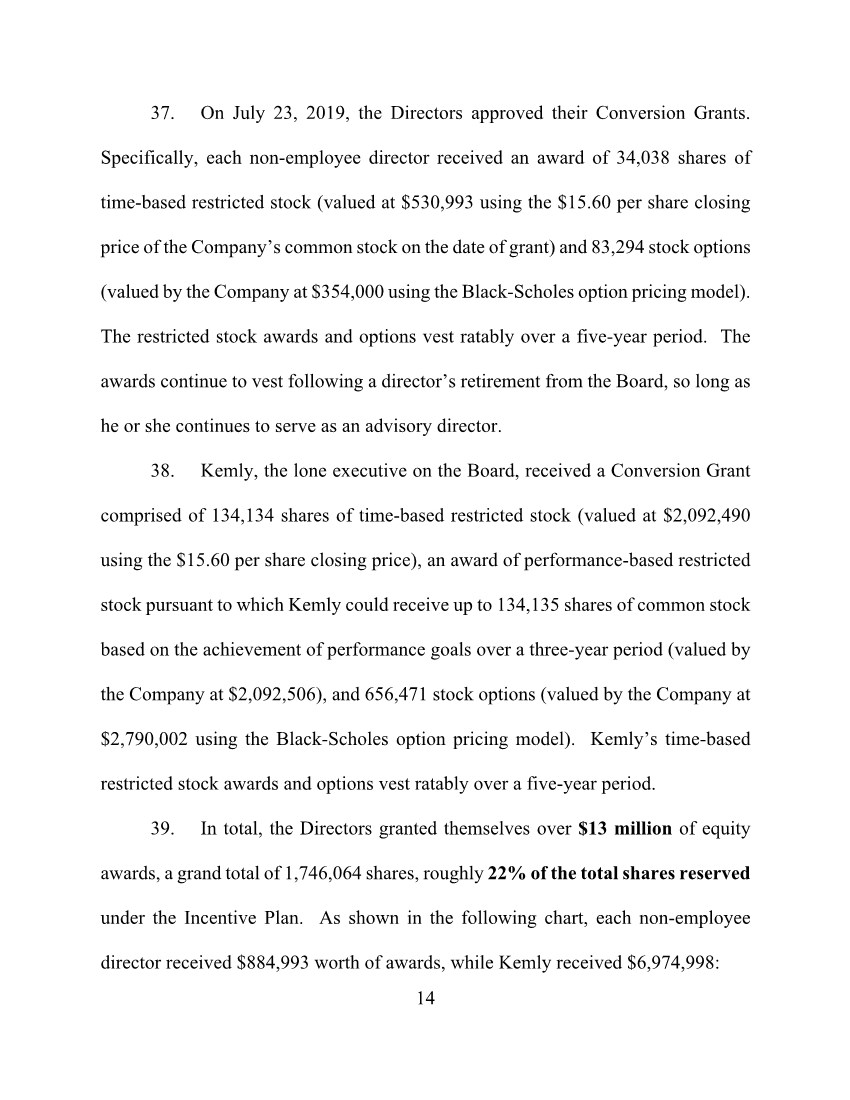

This proxy statement is being sent to you by the Board of Directors of the Company to request that you allow your shares of the Company common stock to be represented at the annual meetingSpecial Meeting by the persons named in the enclosed proxy card. All shares of Company common stock represented at the meeting by properly executed and dated proxies will be voted according to the instructions indicated on the proxy card. If you vote online or by telephone, or if you sign, date and return a proxy card without giving voting instructions, your shares will be voted as recommended by the Company’s Board of Directors.

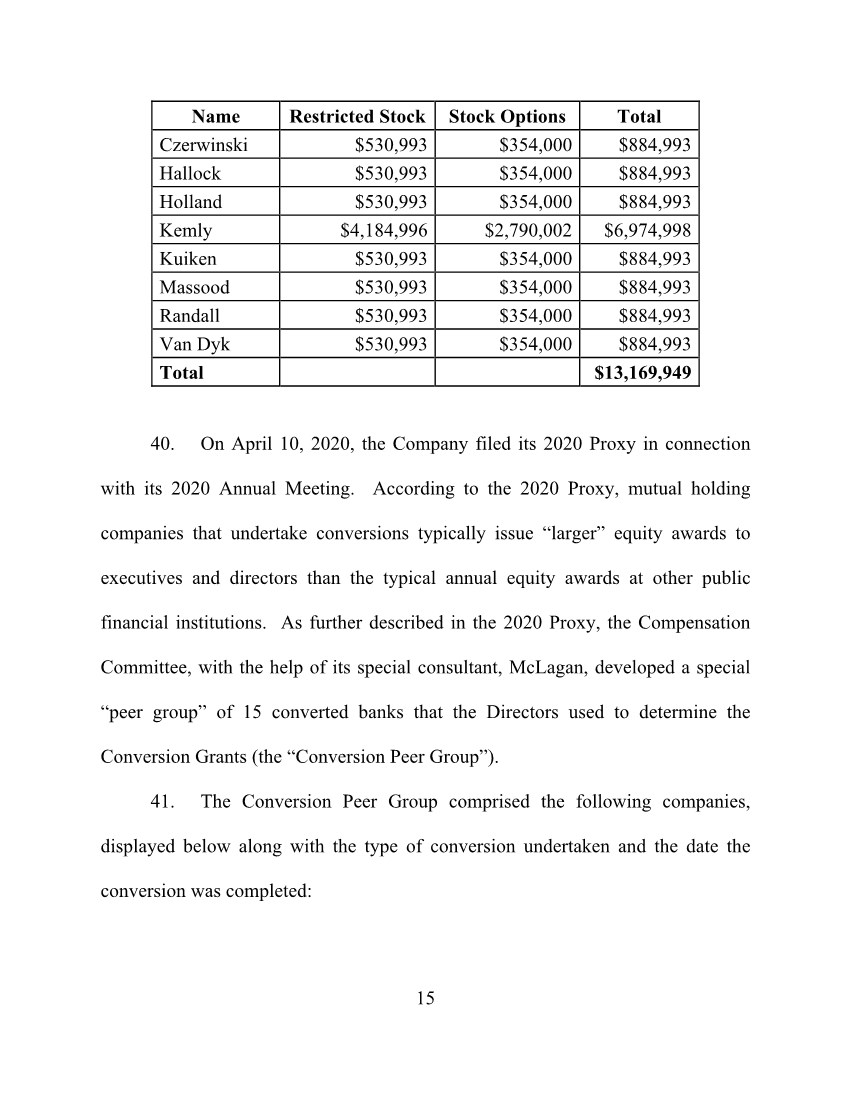

The Board of Directors recommends that you vote:

•

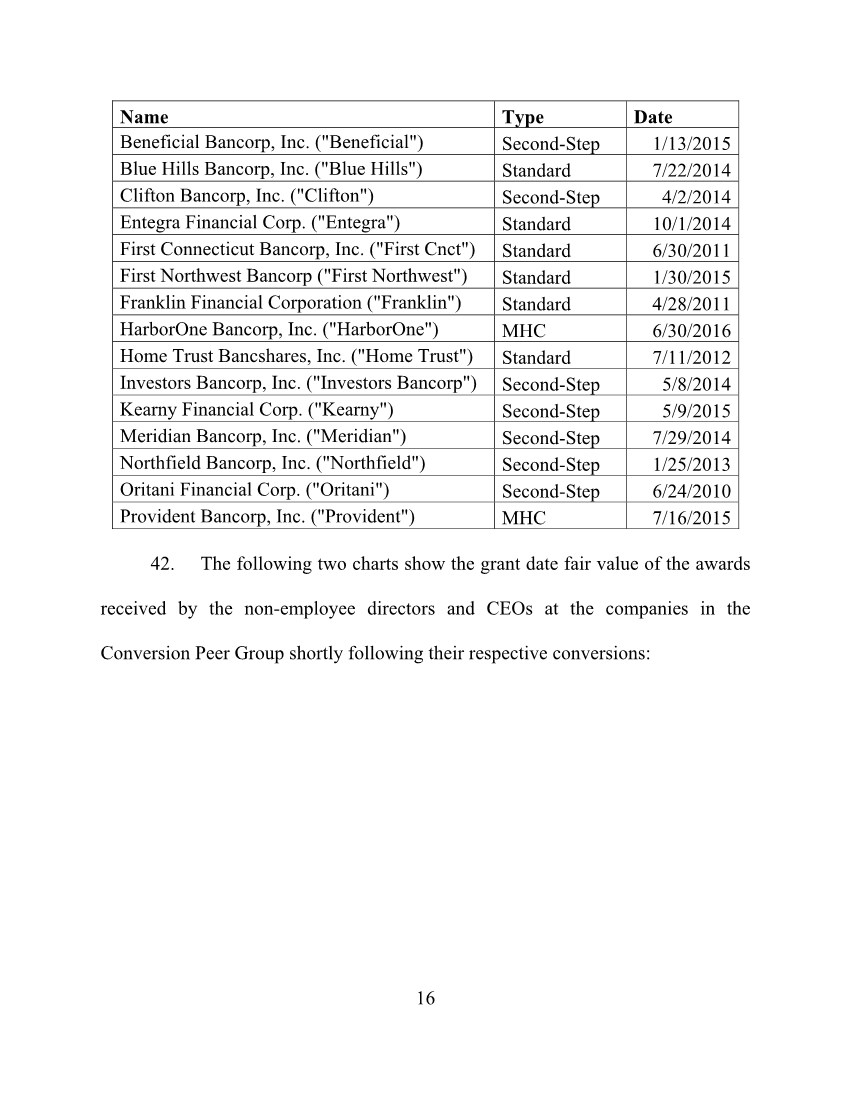

“FOR” eachFOR the ratification of 2019 Equity Awards made to current non-employee Directors of the nominees for director;

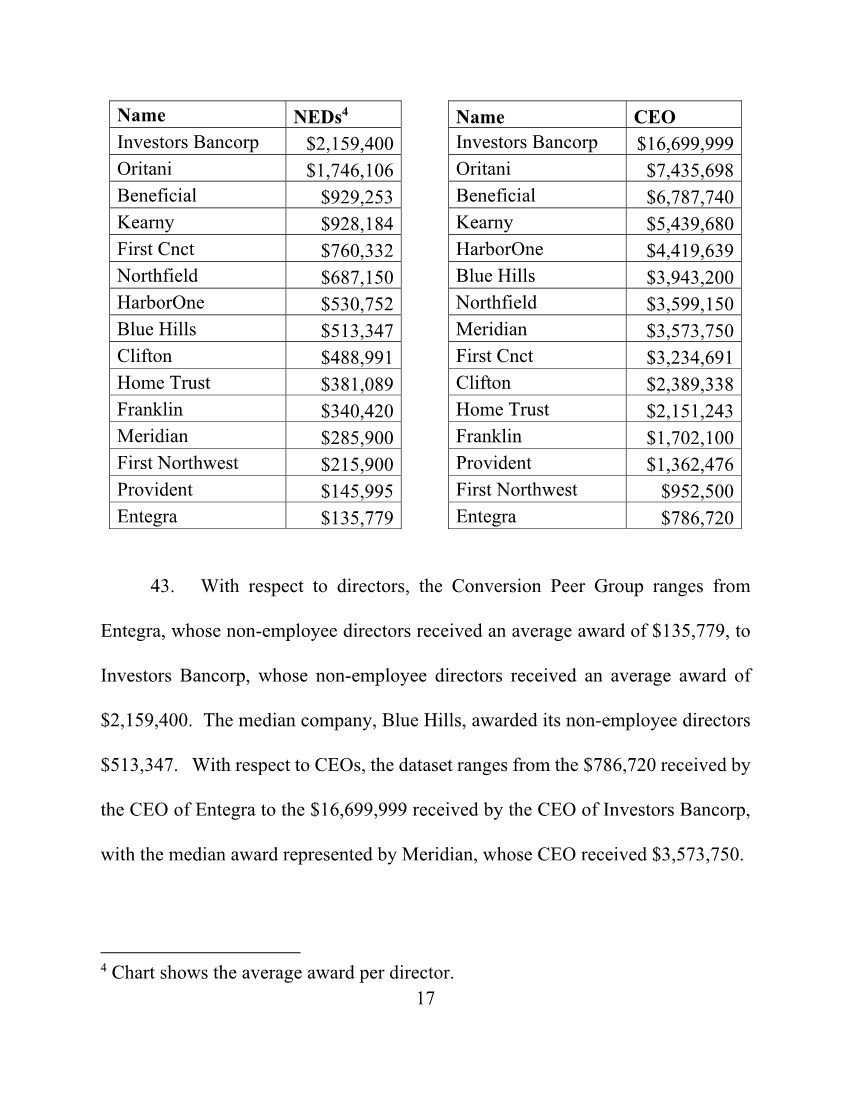

•

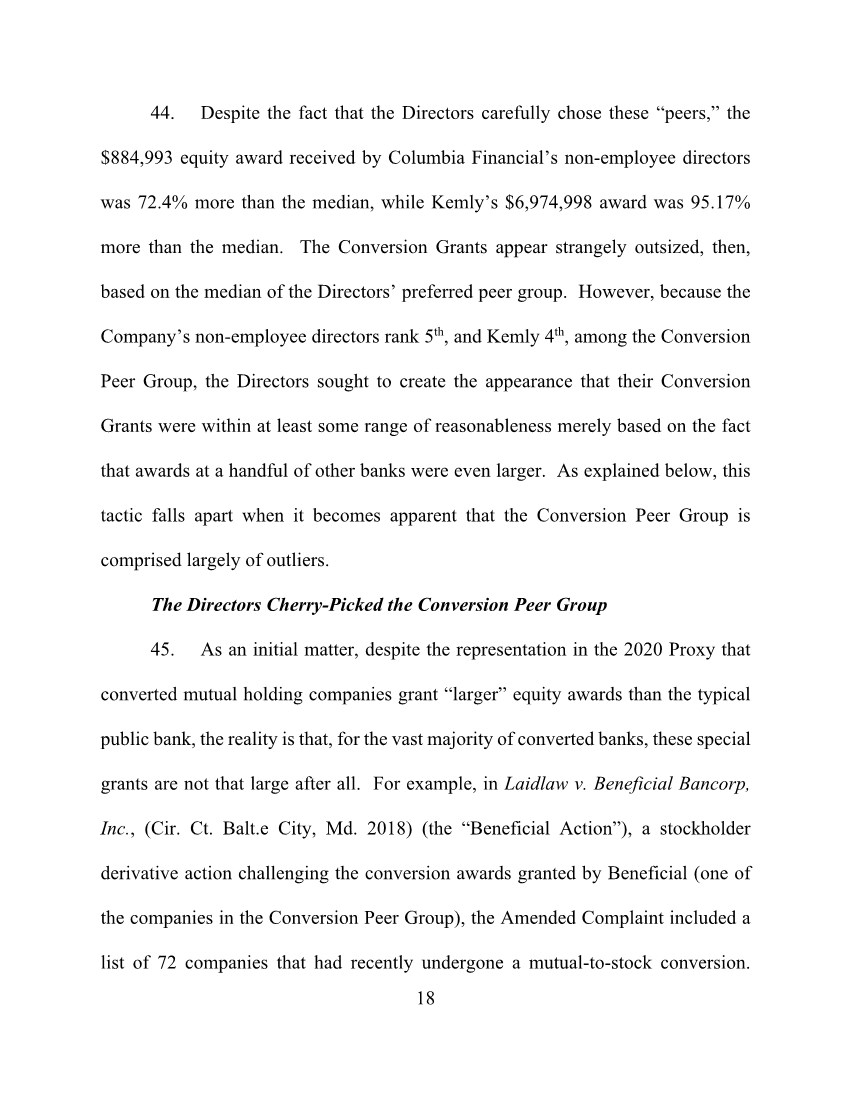

“FOR” the approval ofCompany under the Columbia Financial, Inc. 2019 Equity Incentive Plan; and

•

“FOR”FOR the ratification of the appointment2019 Equity Awards made to former non-employee Directors under the Columbia Financial, Inc. 2019 Equity Incentive Plan, who were incumbent directors at the time the awards were made, who are currently retired from the Board of KPMG LLPDirectors of the Company and have been in continuous service with the Company as advisory directors since their retirements; and

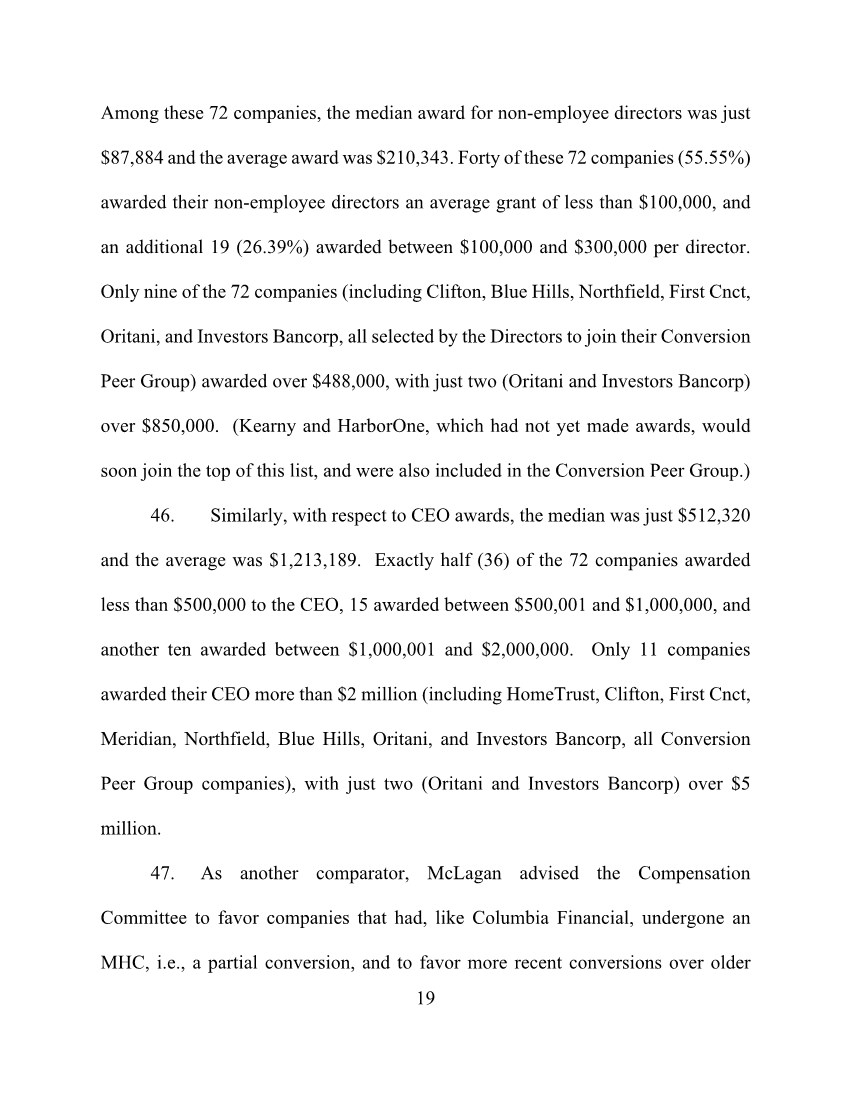

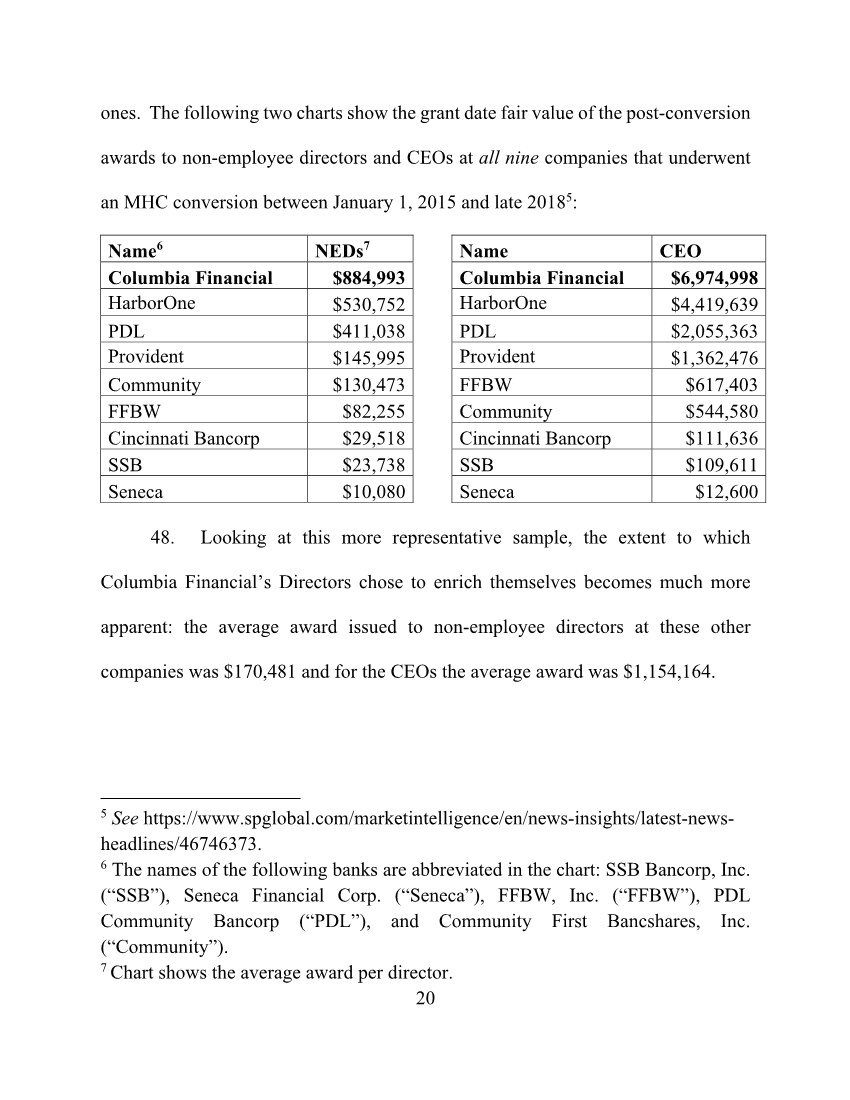

•

FOR the Company’s independent registered public accounting firm.ratification of 2019 Equity Awards made to Thomas J. Kemly, President and Chief Executive Officer of the Company under the Columbia Financial, Inc. 2019 Equity Incentive Plan

If any matter not described in this proxy statement is properly presented at the annual meeting,Special Meeting, the persons named in the proxy card will use their judgment to determine how to vote your shares. This includes a motion to adjourn or postpone the meeting in order to solicit additional proxies. If the annual meetingSpecial Meeting is postponed or adjourned, your shares of Columbia Financial common stock may also be voted by the persons named in the proxy card on the new meeting date, unless you have revoked your proxy. The Company does not know of any other matters to be presented at the annual meeting.Special Meeting.

You may revoke your proxy at any time before the vote is taken at the annual meeting.Special Meeting. To revoke your proxy, you must advise the Corporate Secretary of the Company in writing before your Company common stock has been voted at the annual meeting,Special Meeting, deliver a later-dated valid proxy or attend the meeting and vote your shares in person.online. In addition, if you voted by telephone or via the Internet,internet, you may revoke your vote by following the instructions provided for each. Attendance at the annual meetingvirtual Special Meeting will not in itself constitute revocation of your proxy.

If your Columbia Financial common stock is held in street name, you will receive instructions from your broker, bank or other nominee that you must follow to have your shares voted. Your broker, bank or other nominee may allow you to deliver your voting instructions by telephone or by the Internet.internet. Please see the instruction form provided by your broker, bank or other nominee that accompanies this proxy statement. If you wish to change your voting instructions after you have returned your voting instruction form to your broker, bank or other nominees,nominee, you must contact your broker, bank or other nominee.

If you have any questions about voting, please contact our proxy solicitor, Equiniti (US) ServicesAlliance Advisors, LLC, toll free, at 833.270.9824.(833) 501-4813.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

Unless you elect to receive paper copies of our proxy materials, we are sending our shareholders a Notice of Internet Availability of Proxy Materials (“Notice”) that will instruct you on how to access the proxy materials and proxy card to vote your shares by telephone or over the Internet. If you would like to receive a paper copy of our proxy materials free of charge, please follow the instructions included in the Notice. For more information on the Notice, see “Other Information — Notice and Accessibility of Proxy Materials” below.

It is anticipated that the Notice will be mailed to stockholders on or before April 22, 2019.

The Notice, thisThis Proxy Statement and our Annual Report areis available at our website under Investor Relationsto shareholders online at http://ir.columbiabankonline.com.ir.columbiabankonline.com.

CORPORATE GOVERNANCE

GeneralThe 2019 Equity Incentive Plan and the Awards Made Thereunder

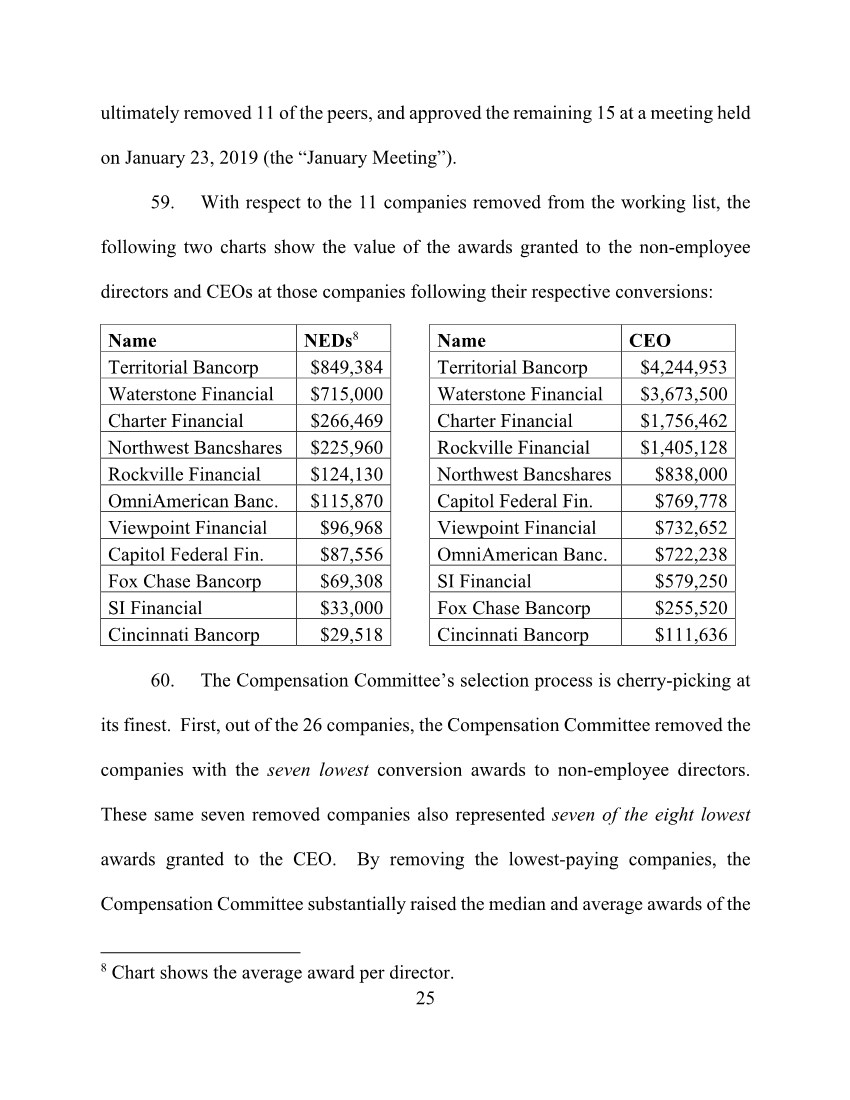

The Company periodically reviewscompleted its corporate governance policies and procedures to ensure that the Company meets the highest standards of ethical conduct, reports results with accuracy and transparency and maintains full compliance with the laws, rules and regulations that govern the Company’s operations.minority stock public offering in April, 2018. As part of this periodic corporate governance review, the Board of Directors reviews and adopts best corporate governance policies and practices for the Company.

Code of Ethics and Business Conduct

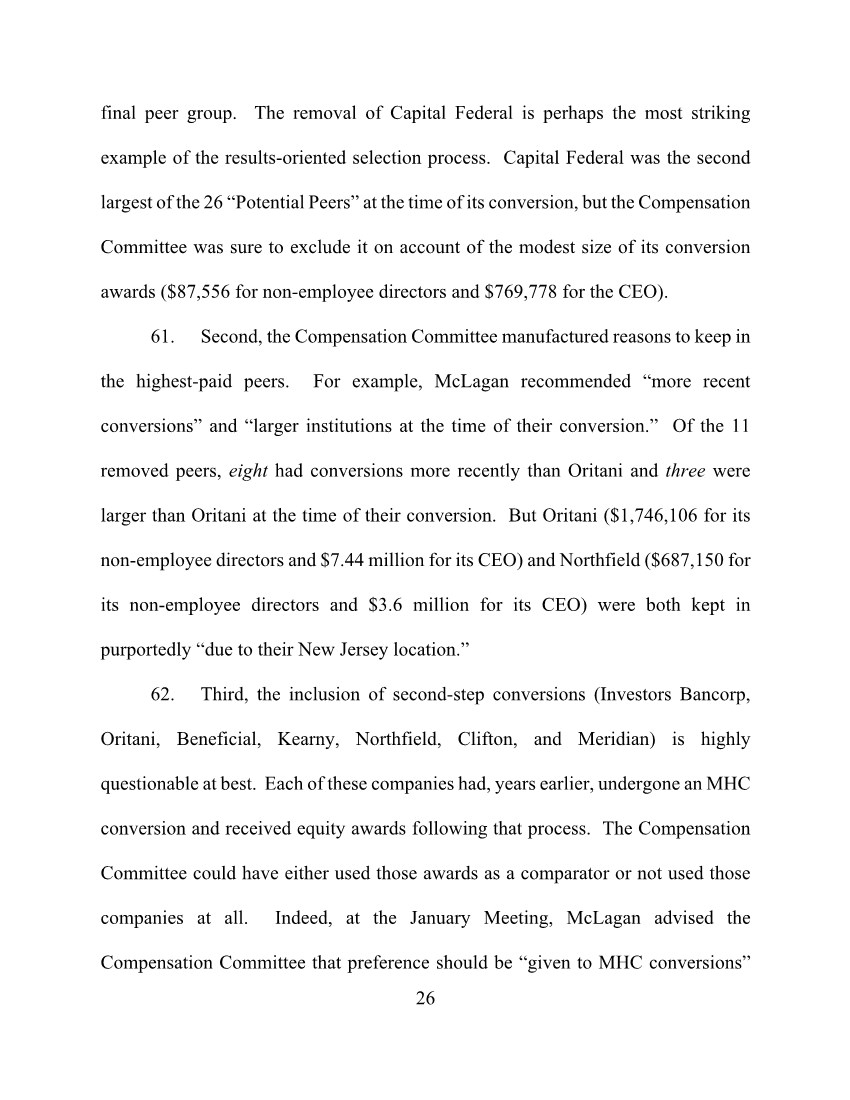

The Company has adopted a Code of Ethics and Business Conduct that applies to all of its directors, officers and employees, including its principal executive officer, principal financial officer and principal accounting officer and persons performing similar functions. The Code of Ethics and Business Conduct is available upon written request to Corporate Secretary, Columbia Financial, Inc., 19-01 Route 208 North, Fair Lawn, New Jersey 07410 and on the Company’s website at http://ir.columbiabankonline.com. If the Company amends or grants any waiver from a provision of the Code of Ethics and Business Conduct that applies to its executive officers, it will publicly disclose such amendment or waiver on its website and as required by applicable law, including by filing a Current Report on Form 8-K with the U.S. Securities and Exchange Commission.

Meetings and Committees of the Board of Directors

The Company conducts business through meetings of its Board of Directors and its committees. The Company’s Board of Directors held ten regular meetings and six special meetings during the fiscal year ended December 31, 2018. No director attended fewer than 75% of the total meetings of the Company’s Board of Directors and committees on which such director served.

The following table identifies our standing committees and their members as of April 12, 2019. All members of each committee are independent in accordance with the listing standards of the Nasdaq Stock Market, Inc. The Board of Directors has adopted a written charter for each committee that, among other things, specifies the scope of each committee’s rights and responsibilities. A copy of each committee charter is available in the Investor Relations section of the Company’s website at http://ir.columbiabankonline.com.

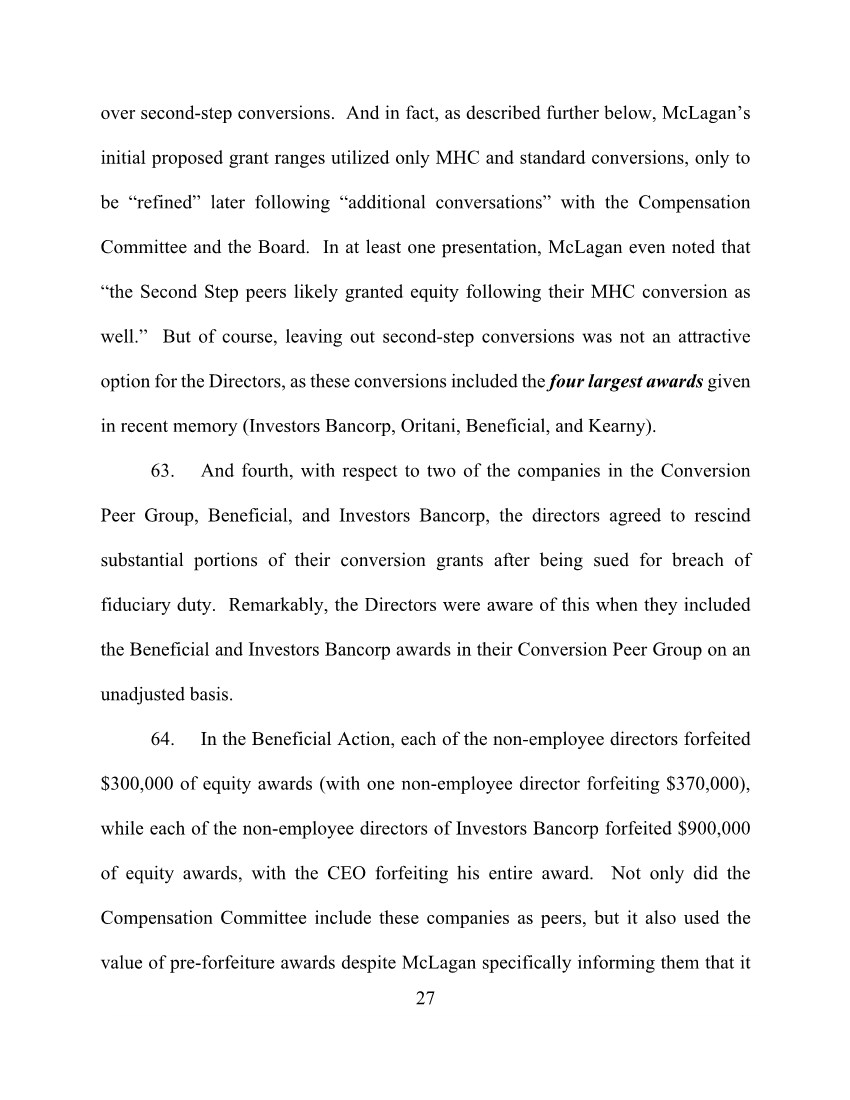

| Director | | | Audit

Committee | | | Compensation

Committee | | | Nominating/Corporate

Governance

Committee | | | Risk

Committee | |

| Noel R. Holland | | | | | X | | | | | | X* | | | | | | X | | | | | | X* | | |

| Frank Czerwinski | | | | | | | | | | | X | | | | | | X* | | | | | | X | | |

| Raymond G. Hallock | | | | | X | | | | | | | | | | | | X | | | | | | X | | |

| Thomas J. Kemly. | | | | | | | | | | | | | | | | | | | | | | | X | | |

| Henry Kuiken | | | | | | | | | | | X | | | | | | | | | | | | X | | |

| Michael Massood, Jr. | | | | | X* | | | | | | | | | | | | | | | | | | X | | |

| Elizabeth E. Randall | | | | | X | | | | | | | | | | | | X | | | | | | X | | |

| Robert Van Dyk | | | | | | | | | | | X | | | | | | | | | | | | X | | |

| Number of Meetings in 2018 | | | | | 8 | | | | | | 7 | | | | | | 3 | | | | | | 4 | | |

*

Chairman

Audit Committee. The Audit Committee assists the Board of Directors in discharging its duties related to the integrity of our financial statements, our compliance with legal and regulatory requirements, our independent auditors’ qualifications, independence and performance, the performance of our internal audit function, our accounting and financial reporting process and financial statement audits. Among other things, the responsibilities of the Audit Committee include:

•

Being responsible for the appointment, compensation, retention and oversight of the independent auditors;

•

Reviewing the Company’s annual and quarterly consolidated financial statements with management and the independent auditors;

•

Overseeing internal audit activities;

•

Pre-approving all audit and permissible non-audit services to be performed by the Company’s independent auditors;

•

Authorizing, reviewing, and approving the Audit Committee Report to be included in the Company’s annual proxy statement;

•

Reviewing and approving any third party transactions;

•

Establishing procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and for the confidential, anonymous submission by its employees of concerns regarding questionable accounting or auditing matters; and

•

Reviewing the Audit Committee’s performance and the adequacy of the Audit Committee’s charter on an annual basis.

The Company also provides for appropriate funding, as determined by the Audit Committee, for payment of compensation to the Company’s independent auditors, any independent counsel or other advisors engaged by the Audit Committee and for administrative expenses of the Audit Committee that are necessary or appropriate in carrying out its duties.

The Board of Directors has designated Michael Massood, Jr. as an audit committee financial expert under the rules of the Securities and Exchange Commission. Mr. Massood is independent under the listing requirements of the Nasdaq Stock Market, Inc. applicable to audit committee members.

The report of the Audit Committee appears in this proxy statement under the heading “Proposal 3 — Ratification of Independent Registered Public Accounting Firm — Audit Committee Report.”

Compensation Committee. The Compensation Committee establishes, administers and reviews the Company’s policies, programs and procedures for compensating its executive officers and directors. The functions and responsibilities of the Compensation Committee include:

•

Overseeing the Company’s overall compensation structure, policies and programs, and assessing whether the Company’s compensation structure establishes appropriate incentives for management and employees;

•

Reviewing and approving annually the corporate goals and objectives applicable to the compensation of the President and Chief Executive Officer, evaluating at least annually the President and Chief Executive Officer’s performance in light of these goals and objectives, and recommending the President and Chief Executive Officer’s compensation level based on this evaluation;

•

In collaboration with the President and Chief Executive Officer, reviewing and evaluating the performance of the Company’s executive officers and approving such other executive officers’ compensation and benefits;

•

Reviewing, administering and making recommendations to the Board of Directors with respect to the Company’s incentive compensation and equity-based plans;

•

Reviewing and making recommendations to the Board of Directors regarding employment or severance arrangements or plans;

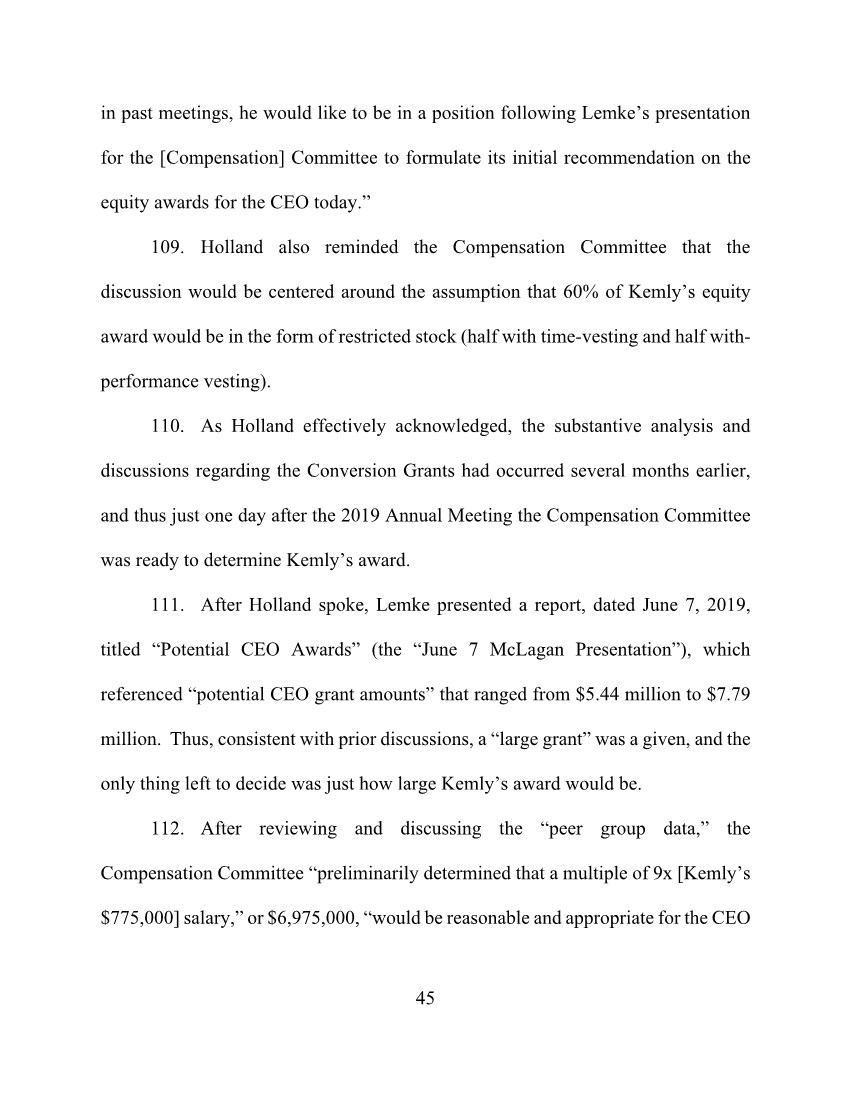

•

Reviewing the Company’s incentive compensation arrangements to determine whether they encourage any excessive risk-taking, reviewing at least annually the relationship between risk management policies and practices and compensation and evaluating compensation policies and practices that could mitigate any such risk;

•

Retaining such compensation consultants, legal counsel or other advisors as the Compensation Committee deems necessary or appropriate for it to carry out its duties, with direct responsibility for the appointment, compensation and oversight of work of such consultants, counsels and advisors;

•

Preparing a report on executive compensation for inclusion in the Company’s annual meeting proxy statement;

•

Reviewing and making recommendations to the Board of Directors with respect to the compensation of the Company’s directors;

•

Developing a succession plan for our executive officer positions, reviewing it periodically and developing and evaluating potential candidates for succession; and

•

Reviewing the Compensation Committee’s performance and the adequacy of its charter on an annual basis.

Nominating/Corporate Governance Committee. The Nominating/Corporate Governance Committee is responsible for assisting the Board of Directors in discharging its duties related to corporate governance and nominating functions. Among other things, the functions and responsibilities of the Nominating/Corporate Governance Committee include:

•

Developing policies on the size and composition of the Company’s Board of Directors;

•

Developing and recommending to the Board of Directors criteria to be used in identifying and selecting nominees for director;

•

Reviewing possible candidates for election to the Board of Directors;

•

Recommending to the Board of Directors candidates for election or re-election to the Board of Directors;

•

Recommending committee structure, composition and assignments;

•

Conducting an annual performance evaluation of the Board of Directors and its committees; and

•

Reviewing the Nominating/Corporate Governance Committee’s performance and the adequacy of its charter on an annual basis.

Minimum Qualifications. The Nominating/Corporate Governance Committee has adopted a set of criteria that it considers when it selects individuals to be nominated for election to the Board of Directors. First, a candidate must meet the eligibility requirements set forth in the Company’s Bylaws, which include an age limitation. A candidate also must meet any qualification requirements set forth in any Board or committee governing documents.

The Nominating/Corporate Governance Committee will considerprospectus for that offering, one of the following criteria in selecting nominees: contributions to the range of talent, skill and expertise appropriateprimary reasons for the Board; financial, regulatory and business experience; knowledge of the banking and financial services industries; familiarity with the operations of public companies and ability to read and understand financial statements; familiarity with the Company’s market area and participation in and ties to local businesses and local civic, charitable and religious organizations; personal and professional integrity, honesty and reputation; ability to represent the best interests of the shareholders ofoffering was for the Company and the best interests of the Bank; ability to devote sufficient time and energy to the performance of his or her duties; independence; current equity holdings in the Company; and any other factors the Nominating/Corporate Governance Committee deems relevant, including age, diversity, size of the Board of

Directors and regulatory disclosure obligations. In its consideration of diversity, the Nominating/Corporate Governance Committee seeks to create a Board that is strong in its collective knowledge and that has a diverse set of skills and experience with respect to management and leadership, vision and strategy, accounting and finance, business operations and judgment, industry knowledge and corporate governance.

In addition, prior to nominating an existing director for re-election to the Board of Directors, the Nominating/Corporate Governance Committee will consider and review an existing director’s Board and committee attendance and performance; length of Board service; experience, skills and contributions that the existing director brings to the Board; and independence.

Director Nomination Process. The process that the Nominating/Corporate Governance Committee follows when it identifies and evaluates individuals to be nominated for election to the Board of Directors is as follows:

For purposes of identifying nominees for the Board of Directors, the Nominating/Corporate Governance Committee relies on personal contacts of the committee members and other members of the Board of Directors, as well as its knowledge of members of the communities served by the Bank. The Nominating/Corporate Governance Committee also will consider director candidates recommended by shareholders in accordance with the policy and procedures set forth below. The Nominating/Corporate Governance Committee has not previously used an independent search firm to identify nominees.

In evaluating potential nominees, Nominating/Corporate Governance Committee determines whether the candidate is eligible and qualified for service on the Board of Directors by evaluating the candidate under the selection criteria set forth above. In addition, the Nominating/Corporate Governance Committee will conduct a check of the individual’s background and interview the candidate to further assess the qualities of the prospective nominee and the contributions he or she would make to the Board.

Consideration of Recommendations by Shareholders. It is the policy of the Nominating/Corporate Governance Committee to consider director candidates recommended by shareholders who appear to be qualified to serve on the Company’s Board of Directors. The Nominating/Corporate Governance Committee may choose not to consider an unsolicited recommendation if no vacancy exists on the Board of Directors and the Nominating/Corporate Governance Committee does not perceive a need to increase the size of the Board of Directors. In order to avoid the unnecessary use of the Nominating/Corporate Governance Committee’s resources, the Nominating/Corporate Governance Committee will consider only those director candidates recommended in accordance with the procedures set forth below.

Procedures to be Followed by Shareholders. To submit a recommendation of a director candidate to the Nominating/Corporate Governance Committee, a shareholder must submit the following information in writing, addressed to the Chairman of the Nominating/Corporate Governance Committee, care of the Corporate Secretary, at the main office of the Company:

1.

The name of the person recommended as a director candidate;

2.

All information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended;

3.

The written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving as a director if elected;

4.

As to the shareholder making the recommendation, the name and address, as they appear on the Company’s books, of such shareholder; provided, however, that if the shareholder is not a registered holder of the Company’s common stock, the shareholder should submit his or her name and address along with a current written statement from the record holder of the shares that reflects ownership of the Company’s common stock; and

5.

A statement disclosing whether such shareholder is acting with or on behalf of any other person and, if applicable, the identity of such person.

In order for a director candidate to be considered for nomination by the Board of Directors at the Company’s annual meeting of shareholders, the recommendation must be received by the Nominating/Corporate Governance Committee at least 120 calendar days prior to the date the Company’s proxy statement was released to shareholders in connection with the previous year’s annual meeting, advanced by one year.

Board Leadership Structure

Our Board of Directors has determined that the separation of the offices of Chairman of the Board and President and Chief Executive Officer enhances Board independence and oversight. Moreover, the separation of the positions of Chairman of the Board and President and Chief Executive Officer enables the President and Chief Executive Officer to focus on his responsibilities of running Columbia Financial and Columbia Bank and expanding and strengthening our franchise while enabling the Chairman of the Board to lead the Board of Directors in its fundamental role of providing advice to and independent oversight of management. Consistent with this determination, Noel R. Holland, who is independent under the listing requirements of the Nasdaq Stock Market, serves as Chairman of the Board and Thomas J. Kemly serves as President and Chief Executive Officer.

Board Oversight of Risk Management

Our Board of Directors believes that effective risk management and control processes are critical to our safety and soundness, our ability to predict and manage the challenges that we face and, ultimately, our long-term corporate success. Our Board of Directors, both directly and through its committees, is responsible for overseeing our risk management processes, with each of the committees of our Board of Directors assuming a different and important role in overseeing the management of the risks the Company faces. The Risk Committee, which is comprised of the entire Board of Directors, oversees the identification and management of the various risks we face including, among other things, financial, credit, collateral, consumer compliance, operational, Bank Secrecy Act, fraud, cyber security, vendor and insurable risks.

The Audit Committee of the Board of Directors is responsible for overseeing risks associated with financial matters (particularly financial reporting, accounting practices and policies, disclosure controls and procedures and internal control over financial reporting). The Compensation Committee of the Board of Directors has primary responsibility for risks and exposures associated with our compensation policies, plans and practices, regarding both executive compensation and the Company’s compensation structure generally. In particular, our Compensation Committee, in conjunction with our President and Chief Executive Officer and other members of our management, as appropriate, reviews our incentive compensation arrangements to ensure these programs are consistent with applicable laws and regulations, including safety and soundness requirements, and do not encourage imprudent or excessive risk-taking by our employees. The Nominating/Corporate Governance Committee of the Board of Directors oversees risks associated with the independence of our Board of Directors and potential conflicts of interest.

Our senior management is responsible for implementing our risk management processes, including by assessing and managing the risks we face, including strategic, operational, regulatory, investment and execution risks, on a day-to-day basis, and reporting to our Board of Directors regarding our risk management processes. Our senior management is also responsible for creating and recommending to our Board of Directors for approval appropriate risk appetite metrics reflecting the aggregate levels and types of risk we are willing to accept in connection with the operation of our business and pursuit of our business objectives.

The role of our Board of Directors in our risk oversight is consistent with our leadership structure, with our President and Chief Executive Officer and the other members of senior management having responsibility for assessing and managing our risk exposure, and our Board of Directors and its

PROPOSAL 1. ELECTION OF DIRECTORS

Director Compensation

During 2018, the non-employee directors of Columbia Bank received compensation for service and attendance as follows:

•

The Chairman of the Board of Directors received an annual retainer of $134,500;

•

The Chairman of the Audit Committee received an annual retainer of $7,500;

•

Directors (other than the Chairman of the Board) received an annual retainer of $67,800;

•

Members of the Nominating/Corporate Governance Committee received an annual retainer of $5,000;

•

The Chairman of the Board received an additional fee of $1,500 for each board meeting attended.

•

Directors (other than the Chairman of the Board) received an additional fee of $1,300 for each board meeting attended.

Board members do not receive any additional compensation as a result of their service as directors of Columbia Financial or Columbia Bank MHC.

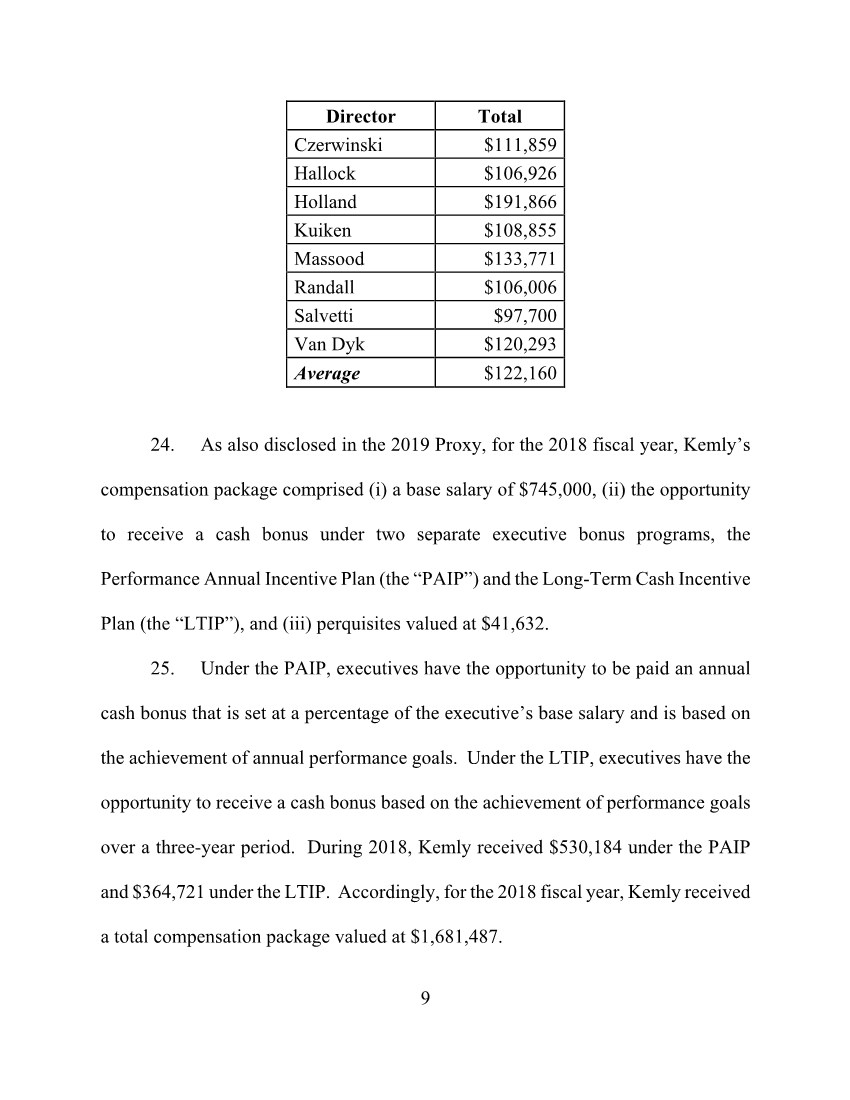

The following table sets forth the compensation received by individuals who served as our non-employee directors during the year ended December 31, 2018.

| Name | | | Fees Earned

or Paid in

Cash | | | Nonqualified

Deferred

Compensation

Earnings | | | All Other

Compensation(1) | | | Total | |

| Frank Czerwinski | | | | $ | 110,400 | | | | | $ | — | | | | | $ | 1,459 | | | | | $ | 111,859 | | |

| Raymond G. Hallock | | | | | 102,700 | | | | | | — | | | | | | 4,226 | | | | | | 106,926 | | |

| Noel R. Holland | | | | | 187,500 | | | | | | — | | | | | | 4,366 | | | | | | 191,866 | | |

| Henry Kuiken | | | | | 101,600 | | | | | | — | | | | | | 7,255 | | | | | | 108,855 | | |

| Michael Massood, Jr. | | | | | 107,800 | | | | | | — | | | | | | 25,971 | | | | | | 133,771 | | |

| Elizabeth E. Randall | | | | | 105,300 | | | | | | — | | | | | | 706 | | | | | | 106,006 | | |

Jack R. Salvetti(2) | | | | | 97,700 | | | | | | — | | | | | | — | | | | | | 97,700 | | |

| Robert Van Dyk | | | | | 102,900 | | | | | | — | | | | | | 17,393 | | | | | | 120,293 | | |

(1)

Represents health insurance and term life insurance premiums.

(2)

Mr. Salvetti resigned from the Board of Directors effective January 23, 2019.

Director Deferred Compensation Plan. We maintain a Director Deferred Compensation Plan in order to provide a deferred compensation opportunity to directors of Columbia Bank. Under the plan, a director may elect to defer up to 100% of his or her total cash compensation (including retainers and meeting fees) expected to be earned during a plan year. Interest is credited on a director’s account balance at the Federal Funds Rate plus one percent. The interest rate is determined as of the first business day of each year and remains the same for the entire year. Upon a director’s termination of service for any reason (or, if elected by a director, upon a change in control of Columbia Bank), Columbia Bank will pay the director his or her accumulated benefit under the plan (i) in a lump sum payment as soon as practicable following his or her termination of service (or change in control, as applicable) or (ii) if elected by the director, as an annual benefit in twelve equal monthly installments payable over a period of up to ten years on the first day of each month commencing with the month following his or her termination of service (or change in Control, as applicable). The plan further provides that if a director fails to make a payment election, or if a director’s accumulated benefit under the plan is less than $10,000, the director’s benefit will be paid in a lump sum. In addition, a director is permitted to elect to receive an in-service distribution of a specific year’s deferrals as adjusted for interest, subject to certain limitations. In connection with the public offering, in 2018, directors were provided with the opportunity to direct the investment of portions of their plan account balances into phantom shares of common stock by way of a transfer of these amounts to the Columbia Bank Stock-Based Deferral Plan.

PROPOSAL 2. APPROVAL OF THE COLUMBIA FINANCIAL, INC. 2019 EQUITY INCENTIVE PLAN

Overview

The Columbia Financial Board of Directors unanimously recommends that stockholders approve Columbia Financial, Inc.’s 2019 Equity Incentive Plan (referred to in this proxy statement as the 2019 Equity Plan). Our Board of Directors unanimously approved the 2019 Equity Plan on April 16, 2019. The 2019 Equity Plan will become effective on June 6, 2019 (referred to in this proxy statement as the “Plan Effective Date”) if the Columbia Financial stockholders approve the 2019 Equity Plan on that date. No awards have been made under the 2019 Equity Plan.

No awards may be granted under the 2019 Equity Plan after the tenth anniversary of the Plan Effective Date. However, awards outstanding under the 2019 Equity Plan at that time will continue to be governed by the 2019 Equity Plan and the agreements under which they were granted.

The 2019 Equity Plan reflects the following equity compensation plan best practices:

•

Individual dollar limits on annual cash and equity non-employee director compensation and individual percentage limits on the maximum amount of shares that may be awarded under the 2019 Equity Plan to any one non-employee director pursuant to the Option Award Pool, as defined herein, and the Full Value Award Pool, as defined herein;

•

Limits on the maximum number of shares, in the aggregate, that may be granted to any one employee under the 2019 Equity Plan pursuant to the Option Award Pool and the Full Value Award Pool, respectively;

•

Minimum vesting requirement of one year for all equity-based awards, except that up to 5% of authorized shares may be issued pursuant to awards that do not meet this requirement and any award may provide for accelerated vesting for death, disability, involuntary termination without cause, and resignation for “good reason”;

•

Provides that performance goals may be established by the Compensation Committee in connection with the grant of awards;

•

No grants of below-market stock options or stock appreciation rights (referred to in this proxy statement as SARs);

•

No repricing of stock options or SARs and no cash buyout of underwater stock options or SARs;

•

No payment of dividends or dividend equivalents on stock options or SARs;

•

No payments of dividends or dividend equivalents on any award prior to date on which award vests;

•

No liberal change in control definition;

•

Double trigger treatment upon change in control except to extent awards are not assumed or replaced in change in control;

•

No excise tax gross-ups on “parachute payments”; and

•

Awards subject to Columbia Financial recoupment/clawback policy.

The full text of the 2019 Equity Plan is attached as Annex 1 to this proxy statement, and the following summary of the 2019 Equity Plan is qualified in its entirety by reference to Annex 1.

PROPOSAL 2. APPROVAL OF THE COLUMBIA FINANCIAL, INC. 2019 EQUITY INCENTIVE PLAN

Why Columbia Financial Believes You Should Vote to Approve the 2019 Equity Plan

Our Board of Directors believes that equity-based incentive awards can play a key role in the success of Columbia Financial by encouraging and enabling employees, officers and non-employee directors of Columbia Financial and its subsidiaries, affiliates and divisions, including Columbia Bank (as used in this section, Columbia Financial, Columbia Bank and their respective subsidiaries, divisions and affiliates are collectively referred to as, “Columbia Financial”), upon whose judgment, initiative and efforts Columbia Financial has depended and continues to largely depend for the successful conduct of its business, to acquire an ownership stake in Columbia Financial, thereby stimulating their efforts on behalf of Columbia Financial and strengthening their desire to remain with Columbia Financial. The details of the key design elements of the 2019 Equity Plan are set forth in the section entitled “— Plan Summary” beginning on page 20 of this proxy statement. As is further described therein, we believe our continued future success depends in part on our ability to attract, motivate and retain the talented and highly qualified employees and non-employee directors necessary for our continued growth and success.Historically, We Have Not Been Able to Make Equity-Based Incentive Awards

We view the use of Columbia Financial common stock as part of our compensation program as an important component to our future success because we believe it fosters a pay-for-performance culture that is an important element of our overall compensation philosophy. Columbia Financial believes that equity-based compensation motivates employees to create stockholder value because the value employees realize from equity-based compensation is based on Columbia Financial’s stock price performance. Equity-based compensation aligns the compensation interests of our employees with the investment interests of our stockholders and promotes a focus on long-term value creation because Columbia Financial’s equity-based compensation awards can be subject to vesting and/or performance criteria.

If the 2019 Equity Plan is not approved, Columbia Financial will have to rely entirely on the cash component of its employee compensation program to attract new employees and to retain our existing employees, which may not necessarily align employee compensation interests with the investment interests of Columbia Financial stockholders as well as the alignment achieved by equity-based awards. The inability to provide equity-based awards would likely increase cash compensation expense over time and use up cash that might be better utilized if reinvested in Columbia Financial’s business or returned to Columbia Financial’s stockholders. If the 2019 Equity Plan is approved, it is anticipated that one-half of the cash awards granted to executives for the 2018 – 2021 performance period under Columbia Financial’s existing Long Term Incentive Plan will be replaced with equity awards and that all of the Long Term Incentive Plan cash awards granted for the 2019 – 2022 performance period will be replaced with equity awards. If the event the 2019 Equity Plan is not approved, Columbia Financial could also be at a severe competitive disadvantage as it would not be able to use stock-based awards to recruit and compensate its officers and other key employees and thereby could impact our future growth plans.

Equity Awards Will Enable Us to Better Compete for Talent in Our Marketplace

Most of our competitors offer equity-based compensation to their employees and non-employee directors. We view the ability to offer equity-based compensation as an important step in our ability to compete for talent within our marketplace. If the 2019 Equity Plan is not approved, we will be at a significant disadvantage as compared to our competitors to attract“attract and retain our executives as well as directors and this could affect our ability to achieve our business plan growth and goals.

Adoptionqualified personnel” through the establishment of Equity Based Incentive Plans is Routinely Done by Newly Public Financial Institutions

Columbia Financial completed its minority stock offering on April 19, 2018 and its common stock began trading on April 20, 2018. Prior tostock-based benefit plans. The prospectus further disclosed that time, all of Columbia Financial’s common stock was held by Columbia Bank MHC and Columbia Financial could not provide equity-based incentives to its

PROPOSAL 2. APPROVAL OF THE COLUMBIA FINANCIAL, INC. 2019 EQUITY INCENTIVE PLAN

executive officers, employees and non-employee directors. Of the 64 institutions that conducted a full conversion, minority stock offering or a second-step conversion during the period January 2012 through January 2018, 62 of such institutions adopted equity based incentive plans.

Our Share Reserve is as Disclosed in Connection with our Minority Stock Offering

The number of restricted stock awards and stock options that may be granted under the 2019 Equity Plan, measured as a percentage of total outstanding shares issued in the minority stock offering, is consistent with that which was disclosed in connection with our minority stock offering in 2018 and consistent with the amount permitted under federal banking regulations for equity plans adopted within the first year following a minority stock offering. Although we are not bound by the limits imposed under the federal banking regulations since we will be implementing our plan after the one-year period following our offering, we have determined to maintain the size of the share reserve at that limit. The share pool under the 2019 Equity Plan represents 6.86% of the total shares of Columbia Financial common stock outstanding, of which 1.96% is comprised of the Full Value Award Pool and 4.90% is comprised of the Stock Option Award Pool.

Determination of Shares Available and Share Pool under 2019 Equity Plan

Columbia Financial is requesting approval of 7,949,996 shares of its common stock for awards under the 2019 Equity Plan (referred to in this proxy statement as the share pool), subject to adjustment as described in the 2019 Equity Plan. The shares of common stock issued by Columbia Financial under the 2019 Equity Plan will be currently authorized but unissued shares or shares that may subsequently be acquired as treasury shares, including shares that may be purchased on the open market or in private transactions.

In determining the number of shares to request pursuant to the 2019 Equity Plan, Columbia Financial considered a number of factors, including: (i) the recommendations and analysis provided by McLagan, an AON Hewitt Company (“McLagan”), the independent compensation consultant retained by the Compensation Committee to assist in the design and implementation of the 2019 Equity Plan; (ii) industry practices related to the adoption of equity based incentive plans by recently converted institutions; (iii) applicable banking regulations related to the adoption of equity based incentive plans; and (iv) guidelines issued by proxy advisory firms with respect to equity incentive plans, including the potential cost and dilution to stockholders associated with the share pool.

Columbia Financial disclosed to shareholders in its 2018 minority stock offering that it expectedintended to adopt an equity incentive plan that would includeprovide for grants of stock options and shares of restricted common stock and that the Company expected that, in accordance with regulations applicable to plans adopted within one year following an initial public offering, the plan would authorize the grant of a number of stock options and a number of shares of restricted stock, not to exceed 4.90% and 1.96%, respectively, of the Company’s outstanding shares (including shares issued to Columbia Bank MHC and the Bank’s charitable foundation) and the prospectus disclosed the estimated value of the restricted stock awards and stock options covered by a future equity incentive plan. The pro forma data included in the prospectus assumed that the Company would grant restricted shares equal to 1.96 % and 4.90%, respectively,1.96% of the totaloutstanding shares issuedand options to purchase shares equal to 4.90% of the outstanding shares and included the pro forma impact on net income and earnings per share of such equity incentive grants.

The Company did not implement an equity incentive plan until more than one year after the initial public offering, and therefore the regulatory limits described above were not applicable to the proposed plan. Nonetheless, after considering various alternatives, the Company determined to adopt an equity incentive plan that limited the authorized shares to the regulatory limits disclosed in connection with the minority stock offering, including shares issued to the Columbia Bank Foundation.initial public offering. The total amount of shares we disclosed for the equity incentive plans totaled 7,949,996, which is the amount permitted under applicable bank regulations for equity plans implemented in the one year period following a minority stock offering. Even though we are implementing theCompany’s proxy statement dated April 22, 2019 Equity Plan after the one year period, we have determined to maintain the size of the 2019 Equity Plan at the amount disclosed in connection with our minority stock offering.

Application of Share Pool

Columbia Financial has determined that the 2,271,427 may be issued as restricted stock award shares or restricted stock units, including performance shares and performance units (or 1.96% of total outstanding shares of common stock of Columbia Financial (“Full Value Award Pool”)) and 5,678,569 shares may be issued as stock options or SARs (or 4.90% of total outstanding shares of common stock of Columbia Financial (“Option Award Pool”)).

Incentive Stock Options

One of the requirements for the favorable tax treatment available to Incentive Stock Options (“ISOs”) under the Code is that the 2019 Equity Plan must specify, anddescribed the Columbia Financial, stockholders must approve, the number of shares available for issuance pursuant to ISOs. As a result,

PROPOSAL 2. APPROVAL OF THE COLUMBIA FINANCIAL, INC. 2019 EQUITY INCENTIVE PLAN

in order to provide flexibility to the Committee, theInc. 2019 Equity Incentive Plan provides(the “2019 Equity Incentive Plan”), attached a copy of that all or any portionplan as an exhibit, and solicited shareholder approval of the Option Award Pool may be issued pursuant to ISOs.

Current Stock Price

The closing price of Columbia Financial common stock on The Nasdaq Global Select Market on April 18, 2019 was $15.55 per share.

In evaluating this proposal, stockholders should specifically consider the information set forth under the section entitled “— Plan Summary” beginning on page 20 of this proxy statement.Code Section 162(m)

Section 162(m) of the Internal Revenue Code of 1986, as amended (“Section 162(m)”), as in effect prior to the enactment of the Tax Cuts and Jobs Act (“TCJA”) in December 2017, limited to $1 million the deduction that a company was permitted to take for annual compensation paid to each “covered employee” (at that time defined as the CEO and the three other highest paid executive officers employed at the end of the year other than the CFO), except to the extent the compensation qualified as “performance-based” for purposes of Section 162(m). The TCJA retained the $1 million deduction limit, but it repealed the performance-based compensation exemption and expanded the definition of “covered employees” effective for taxable years beginning after December 31, 2017. “Covered employees” for a fiscal year now include any person who served as CEO or CFO of a company at any time during that fiscal year, the three other most highly compensated company executive officers for that fiscal year (whether or not employed on the last day of that fiscal year) and any other person who was a covered employee in a previous taxable year (but not earlier than 2017) as determined pursuant to the pre-TCJA version of Section 162(m). Any awards that Columbia Financial grants pursuant to the 2019 Equity Plan to covered employees, whether performance-based or otherwise, will be subject to the $1 million annual deduction limitation. While the Compensation Committee intends to consider the deductibility of compensation when making equity awards, it is only one factor it considers. Because of the elimination of the performance-based compensation exemption, the Compensation Committee expects that a portion of the compensation paid to covered employees in the form of equity grants under the 2019 Equity Plan may not be deductible by Columbia Financial.

Plan Summary

The following summary of the material terms of the 2019 Equity Plan is qualified in its entirety by reference to the full text of the 2019 Equity Plan, which is attached as Annex 1 to this proxy statement.proposed plan. The 2019 Equity Plan is not a qualified deferred compensation plan under Section 401(a) of the Code and is not intended to be an employee benefit plan within the meaning of the Employee Retirement Income Security Act of 1974.

Purpose of the 2019 Equity Plan

Theproxy statement stated that “the purpose of the 2019 Equity Plan is to promote the long-term growth and profitability of Columbia Financial and its subsidiaries by (i) providing employees and non-employee directors of Columbia Financial and its subsidiaries, affiliates and division with incentives to maximize stockholdershareholder value and otherwise contribute to the success of Columbia Financial, and (ii) enabling Columbia Financial to attract, retain and reward the best available persons for positions of substantial responsibility and to recognize significant contributions made by such individuals to the Company’s success.

Administration of” For more details on the 2019 Equity Incentive Plan, including a copy of the equity incentive plan, which is attached as an exhibit thereto, see the Company’s 2019 proxy statement, which is available at https://www.sec.gov/Archives/edgar/data/0001723596/000114420419020584/tv515768-def14a.htm.

The 2019 Equity Plan will be administered by the Compensation Committee or such other committee consisting of two or more independent members of the Columbia Financial Board of Directors as may be appointed by the Board of Directors to administer the 2019 Equity Plan (referred to in this proxy statement asalso disclosed to shareholders the “Committee”). If any member of the Committee does not qualify as a

PROPOSAL 2. APPROVAL OF THE COLUMBIA FINANCIAL, INC. 2019 EQUITY INCENTIVE PLAN

“non-employee director” within the meaning of Rule 16b-3 of the Exchange Act, the Columbia Financial Board of Directors will appoint a subcommittee of the Committee, consisting of at least two members of the Columbia Financial Board of Directors, to grantindividual limits imposed on equity awards to officers and members of the Columbia Financial Board of Directors who are subject to Section 16 of the Exchange Act, and each member of such subcommittee must satisfy the above requirements. References to the Committee in this summary include and,any one employee as appropriate, applywell as to any such subcommittee. To the extent permitted by law, the Committee may also delegate its authority to one or more persons who are not members of the Columbia Financial Board of Directors, except that no such delegation will be permitted with respect to officers who are subject to Section 16 of the Exchange Act.

Certain Restrictions

•

No dividend equivalents will be granted with respect to any stock option or SAR. Additionally, no dividends or dividend equivalents will be paid currently with respect to any other award while the award is unvested. Instead, any dividends or dividend equivalents with respect to an unvested award will be accumulated or deemed reinvested until such time as the underlying award becomes vested (including, where applicable, the achievement of performance goals).

•

The minimum vesting period for each award grantednon-employee director under the 2019 Equity Incentive Plan must be at leastand the overall dollar limit for awards made to any one year, provided that up to 5%non-employee director on an annual basis, which included limits on the aggregate of the shares authorized for issuance under theboth cash and equity awards. The 2019 Equity Plan may be issued pursuant to awards with minimum vesting periods of less than one year. In addition, the minimum vesting requirement does not apply to accelerated vesting on account of death, disability, involuntary termination without cause, or resignation for good reason as otherwise permitted by the 2019 Equity Plan. Although no decision has been made, we anticipateproxy statement further stated that the Committee will impose minimum vesting periods onCompany anticipated that the initial grants made under the 2019 Equity Incentive Plan of no less than three (3) years in connection with performance-based awards and up to five (5) years with respect to the time based awards.

Eligible Participants

Employees of Columbia Financial and its subsidiaries and non-employee members of the Columbia Financial and Columbia Bank’s Board of Directors and will be eligible for selection by the Committee for the grant of awards under the 2019 Equity Plan. As of April 16, 2019, approximately 644 employees of Columbia Financial and its subsidiaries and seven (7) non-employee members of the Columbia Financial Board of Directors were eligible for awards under the 2019 Equity Plan.

Types of Awards

The 2019 Equity Plan provides for the grant of performance shares, performance units, restricted stock, restricted stock units (“RSUs”), non-qualified stock options (“NQSOs”), ISOs, and SARs. ISOs may be granted only to employees of Columbia Financial.

Individual Limits

The Committee will determine the individuals to whom awards will be granted, the number of shares subject to an award, and the other terms and conditions of an award. Subject to adjustment as described in the 2019 Equity Plan:

•

For any one non-employee director, the maximum number of stock options and SARs that may be granted over the life of the plan to any one non-employee director shall not exceed 3.5% of the Option Award Pool and the maximum number of restricted stock or RSUs (including performance based awards) that may be granted to any one non-employee director over the life of the plan may not exceed 3.5% of the Full Value Award Pool.

•

For any one non-employee director, the maximum aggregate amount of cash paid in any one fiscal year of Columbia Financial to such non-employee director for service as a member of the Board of Directors during such fiscal year, including service performed in such fiscal year

PROPOSAL 2. APPROVAL OF THE COLUMBIA FINANCIAL, INC. 2019 EQUITY INCENTIVE PLAN

but for which payment is not made until the following fiscal year, and grant date fair value (computed as of the date of grant in accordance with applicable financial accounting rules) of all equity awards granted in such fiscal year to such non-employee director shall not exceed $1,200,000.

•

The maximum number of shares of the Full Value Award Pool that, in the aggregate, may be granted over the life of the 2019 Equity Plan to any one employee participant shall not exceed 25% of the Full Value Award Pool.

•

The maximum number of shares of the Option Award Pool that, in the aggregate, may be granted over the life of the 2019 Equity Plan to any one employee participant shall not exceed 25% of the Option Award Pool.

Although no decision has been made, we anticipate that the initial grants made by the Committee to non-employee directors and employees under the Full Value Award Pool and the Option Award Pool will, in each case,individuals would be less than the limits set forth in the 2019 Equity Plan.

Adjustments

The Committee shall make equitable adjustments in the number and class of securities available for issuance under the 2019 Equity Plan (including under any awards then outstanding), the number and type of securities subject to the individual limits set forth in the 2019 Equity Incentive Plan, which was in fact the case. At the time of the issuance of the 2019 proxy statement and the termsas of any outstanding award, as it determines are necessary and appropriate, to reflect any merger, reorganization, consolidation, recapitalization, reclassification, stock split, reverse stock split, spin-off combination, exchange of shares, distribution to stockholders (other than an ordinary cash dividend), or similar corporate transaction or event.

Performance Shares and Units

The Committee will specify the terms of a performance share or performance unit award in the award agreement. A performance share will have an initial value equal to the fair market value of a share on the date of grant. A performance unit will have an initial value that is establishedthe 2019 annual meeting of shareholders, no decisions had been made by the Compensation Committee atnor the timeBoard of grant. In additionDirectors with respect to specific awards to any non-performance terms applicableCompany officer or employee or the non-employee directors (other than to one named executive officer (“NEO”) who was to receive a certain number of equity awards in connection

with her employment agreement), which was consistent with the performance share or performance unit, the Committee will set one or more performance goals which, depending on the extent to which they are met, will determine the number or value of the performance share or unit that will be paid out to the participant. The Committee may provide for payment of earned performance shares/units in cash, shares of Columbia Financial’s common stock, other Columbia Financial securities or any combination thereof. The Committee will also specify any restrictions applicable to the performance share or performance unit award such as continued service, the length of the restriction period (subject to the one-year minimum described above) and whether any circumstances, such as death, disability, or a change in control, shorten or terminate the restriction period. It is anticipated that the initial grants of any performance shares/units that are madedisclosure contained in the first year following shareholder approval2019 proxy statement that no equity awards were outstanding and that any future equity awards were discretionary and were not determinable at that time other than as disclosed.

At the Company’s 2019 annual meeting of shareholders, the proposal to adopt the 2019 Equity Incentive Plan will include a time-based vesting component of a minimum of three (3) years.

Performance shares/units will possess voting rights and will accrue dividend equivalents only to the extent provided in the award agreement evidencing the award; provided, however, that rights to dividend equivalents are permitted only to the extent they comply with, or are exempt from, Section 409Awas approved by an overwhelming majority of the Code (referred to in this proxy statement as Section 409A). Any rights to dividends or dividend equivalents on performance shares/units or any other award subject to performance conditions will be subject tovotes cast by the same restrictions on vesting and payment asCompany’s minority shareholders (which excludes the underlying award.

Performance Measures

A performance objective may be described in terms of company-wide objectives or objectives that are related to a specific division, subsidiary, employer, department, region, or function in which the participant is employed or as some combination of these (as alternatives or otherwise). A performance

PROPOSAL 2. APPROVAL OF THE COLUMBIA FINANCIAL, INC. 2019 EQUITY INCENTIVE PLAN

objective may be measured on an absolute basis or relative to a pre-established target, results for a previous year, the performance of other corporations, or a stock market or other index. The Committee will specify the period over which the performance goals for a particular award will be measured and will determine whether the applicable performance goals have been metshares held by Columbia Bank MHC) with respect to a particular award following the end96.24% of the applicable performance period.

In determining whether any performance goal has been satisfied,votes cast by the Committee may include or exclude any or all items that are unusual or infrequent, including but not limited to (i) charges, costs, benefits, gains or income associated with reorganizations or restructuringsminority shareholders voting on the proposal in favor of Columbia Financial and its subsidiaries, affiliates and divisions, discontinued operations, goodwill, other intangible assets, long-lived assets (non-cash), real estate strategy (e.g., costs related to lease terminations or facility closure obligations), litigation or the resolution of litigation (e.g., attorneys’ fees, settlements or judgments), or currency or commodity fluctuations; and (ii) the effects of changes in applicable laws, regulations, tax laws or accounting principles. In addition, the Committee may adjust any performance goal for a performance period as it deems equitable to recognize unusual or infrequent events affecting Columbia Financial and its subsidiaries, affiliates and divisions, changes in laws or regulations or accounting principles, mergers, acquisitions and divestitures, or any other factors as the Committee may determine.

Restricted Stock and Restricted Stock Unitsplan.

The Committee will specify the termsCompany’s 2020 Annual Report on Form 10-K disclosed to shareholders that in July of a restricted stock or RSU award in the award agreement, including the number of shares of restricted stock or number of RSUs; the purchase price, if any, to be paid for such restricted stock or RSU (which may be equal to or less than the fair market value of a share and may be zero, subject to such minimum consideration as may be required by applicable law); any restrictions applicable to the restricted stock or RSUs such as continued service or achievement of performance goals; the length of the restriction period (subject to the one-year minimum described above) and whether any circumstances, such as death, disability, or a change in control, shorten or terminate the restriction period; the rights of the participant during the restriction period to vote and receive dividends in the case of restricted stock or to receive dividend equivalents in the case of RSUs that accrue dividend equivalents (subject to the limitations described below); and whether RSUs will be settled in cash, shares of Columbia Financial’s common stock or any combination thereof.

Generally, a participant who receives a restricted stock award will have (during and after the restriction period), all of the rights of a stockholder of Columbia Financial with respect to that award, including the right to vote the shares and the right to receive dividends and other distributions to the extent, if any, such shares possess such rights and subject to the limitations described in this paragraph. However, any dividends and other distributions payable on shares of restricted stock during the restriction period shall be either automatically reinvested in additional shares of restricted stock or paid to2019, the Company for the account of the participant, in either case subject to the same vesting restrictions as the underlying award. All terms and conditions for the payment of dividends and other distributions will be included in the award agreement and, to the extent required, comply with the requirements of Section 409A.

A participant receiving an RSU award will not possess voting rights and will accrue dividend equivalents on such units only to the extent provided in the award agreement evidencing the award; provided, however, that any dividend equivalents will be subject to the same vesting restrictions as the underlying award. All terms and conditions for payment of dividends equivalents will be included in the award agreement and, to the extent required, comply with the requirements of Section 409A.

Stock Options

An option provides the participant with the right to buy a specified number of shares at a specified price (referred to in this proxy statement as the exercise price) after certain conditions have been met. The Committee may grant both NQSOs and ISOs under the 2019 Equity Plan. The tax treatment of NQSOs is different from the tax treatment of ISOs as explained below. The Committee will determine

PROPOSAL 2. APPROVAL OF THE COLUMBIA FINANCIAL, INC. 2019 EQUITY INCENTIVE PLAN

and specify in the award agreement evidencing an option whether the option is an NQSO or ISO, the number of shares subject to the option, the exercise price of the option and the period of time during which the option may be exercised, any restrictions applicable to the option such as continued service, the length of the restriction period (subject to the one-year minimum described above) and whether any circumstances, such as death, disability, or a change in control, shorten or terminate the restriction period. Generally (except as otherwise described in the 2019 Equity Plan), no option can be exercisable more than 10 years after the date of grant and the exercise price of a stock option must be at least equal to the fair market value of a share on the date of grant of the option. However, with respect to an ISO granted to a participant who is a stockholder holding more than 10% of Columbia Financial’s total voting stock, the ISO cannot be exercisable more than five years after the date of grant and the exercise price must be at least equal to 110% of the fair market value of a share on the date of grant. ISOs cannot behad granted, under the 2019 Equity Incentive Plan, after April 16, 2029. Dividend equivalents will not be paid1,389,570 shares of restricted stock with respecta grant date fair value of $15.60 per share, and options to options.

A participant may paypurchase 3,707,901 shares of Company common stock, with a grant date fair value of $4.25 per option. Those grants were made to executive officers, directors and a total of 1,444 employees of the exercise price under an optionCompany. The Company’s 2020 proxy statement disclosed that the Company granted to each non-employee director 34,038 shares of restricted stock and options to purchase 83,294 shares of common stock, in cash; in a cash equivalent approved byeach case vesting ratability over five years. The 2020 proxy statement disclosed that the Committee; if approved by the Committee, by tendering previously acquired shares (or delivering a certification or attestation of ownership of such shares) having an aggregate fair market value at the time of exercise equalrestricted stock and options granted to the total option exercise price (providednon-employee Directors had a grant date fair value of $884,993. The 2020 proxy statement also disclosed that the tendered shares must have been held by the participant for any period required by the Committee); or by a combination of these payment methods. The Committee may also allow cashless exercises as permitted under the Federal Reserve Board’s Regulation T, subjectCompany granted to applicable securities law restrictions, or by any other means which the Committee determines to be consistent with the 2019 Equity Plan’s purpose and applicable law. No certificate representing a share (to the extent shares are so evidenced) will be delivered until the full option price has been paid.

Stock Appreciation Rights

A SAR entitles the participant to receive cash,Mr. Kemly 134,134 shares of Columbia Financial’stime-vested restricted stock vesting ratability over five years, options to purchase 656,471 shares of common stock or any combination thereof, as the Committee may determine, in an amount equal to the excessvesting ratability over five years, and 134,135 shares of the fair market value of a share on the exercise date over the exercise price for the SAR, after certain conditions have been met. The Committee will determine and specify in the SAR award agreement the number of shares subject to the SAR, the SAR price (which generally must be at least equal to the fair market value of a share on the date of grant of the SAR) and the period of time during which the SAR may be exercised, any restrictions applicable to the SAR such as continued service, the length of the restriction period (subject to the one-year minimum described above) and whether any circumstances, such as death, disability, or a change in control, shorten or terminate the restriction period. Generally, no SAR can be exercisable more than 10 years after the date of grant. SARs may be granted in tandem with a stock option or independently. If a SAR is granted in tandem with a stock option, the participant may exercise the stock option or the SAR, but not both. Dividend equivalents will not be paid with respect to SARs.

Termination of Employment

Subject to certain exceptions, generally, if a participant ceases to perform services for Columbia Financial and its subsidiaries for any reason (i) all of the participant’sperformance-vested restricted stock RSUs, performance shares, and performance units that were not vested on the date of such cessation shall be forfeited immediately upon such cessation, (ii) all of the participant’s stock options and SARs that were exercisable on the date of such cessation shall remain exercisable for, and shall otherwise terminatewould vest at the end of three years if certain performance targets were met. The restricted stock and options granted to Mr. Kemly had a periodgrant date fair value of 90 days after$6,974,998, which in part replaced existing long-term incentive compensation as explained below. The restricted stock and options described above for the datenon-employee directors and Mr. Kemly are referred to as the “2019 Equity Awards.” The 2020 proxy statement further disclosed that Raymond G. Hallock and Henry Kuiken were retiring from the Board of such cessation, but in no event after the expiration date of the stock options or SARs, and (iii) all of the participant’s stock options and SARs that were not exercisable on the date of such cessation shall be forfeited immediately upon such cessation. The Committee may provide that a participant shall be eligible for a full or prorated award upon a cessation of the participant’s service relationship due to death, disability, involuntary termination without cause or resignation for good reason. For an award subject to one or more performance objectives, the Committee may provide for payment of any such full or prorated award prior to certification of such performance objectives or without regard to whether they are certified.

PROPOSAL 2. APPROVAL OF THE COLUMBIA FINANCIAL, INC. 2019 EQUITY INCENTIVE PLAN

Change in Control

The Committee may, in its sole discretion, provide that any time-based vesting requirement applicable to an Award shall be deemed satisfied in full in the event that both a change in control and a cessation of the participant’s service relationship with Columbia Financial and its subsidiaries occurs or if the surviving entity in such change in control does not assume or replace the award in the change in control. With respect to an award that is subject to one or more performance objectives, the Committee may, in its sole discretion, provide that in the event of a change in control, achievement of such performance objective shall be determinedDirectors effective as of the effective date2020 Annual Meeting, but would continue to remain in service with the Company as advisory directors. Under the terms of the Change in Control or such performance objective shall be deemed achieved at the target level of performance.

Transferability